- Step by step guide to creating a plan for buying a house or land in Croatia (updated for 2021).

Assuming that you already gathered the necessary information about living in Croatia and you decided to buy a property there (whether for living or investing in Croatia), you may wonder what are the next steps you should take.

Specifically, you would like to know if the process of property purchase in Croatia is similar as in your country and what would be the cost of the complete process. This guide will help you understand the legal process of buying a property in Croatia (whether you are looking for a vacation home, or you want to invest in Croatia).

Find a trustworthy agency

Once you identified the region in Croatia and the perfect property, you should find a good agent. The reason for that is that some local agencies can guide you better through the whole property purchase process in Croatia. Agents also speak native languages and they are familiar with the real estate market and its trends. With their help, you could speed up the whole process. Before hiring an agent, don’t forget to do research about the agencies. Start with their website and social media activity, and always check the reviews.

Note: Hiring a lawyer is one of the most overlooked things while buying a house or land in general. Having legal advice should be an essential part of your entire plan. Some of the real estate agencies in Croatia work closely with lawyers or they have a legal department specialized for property buying in Croatia by foreign citizens. This applies only if you don’t have a lawyer already.

If you know someone from your country that bought a property in Croatia, it would be good to ask that person to share the experience. Interview agents from different real estate agencies and check if they are licensed. You can be sure that the agency is trustworthy if it’s a part of the Croatian Chamber of economy. You can enter the name of agents or agencies on the website of the Croatian Chamber of Economy and check if the agencies or agents are in the registry. This way you will avoid potential scammers or illegal agencies.

Who can buy property according to Croatian law?

Foreign citizens can buy real estate in Croatia. But there is one small difference. The difference depends on whether you come from the EU or not.

Buying a property in Croatia if you are an EU citizen

If you are buying the property in Croatia for the first time, you should know that people from foreign countries (which are part of the European Union) can purchase the property the same way as Croatian citizens.

Switzerland and Italy citizens can use this rule if they plan to settle in Croatia permanently.

Buying a property in Croatia if you come outside of the EU

If you come from a country outside of the European Union you can buy a property under the Principle of reciprocity. What does that mean? The Republic of Croatia has the Reciprocity Agreement with other countries that regulate property purchases for its citizens. If the country you are registered in (as a citizen) has an agreement with Croatia you can buy the property. You can check if your country has the reciprocity agreement with Croatia here.

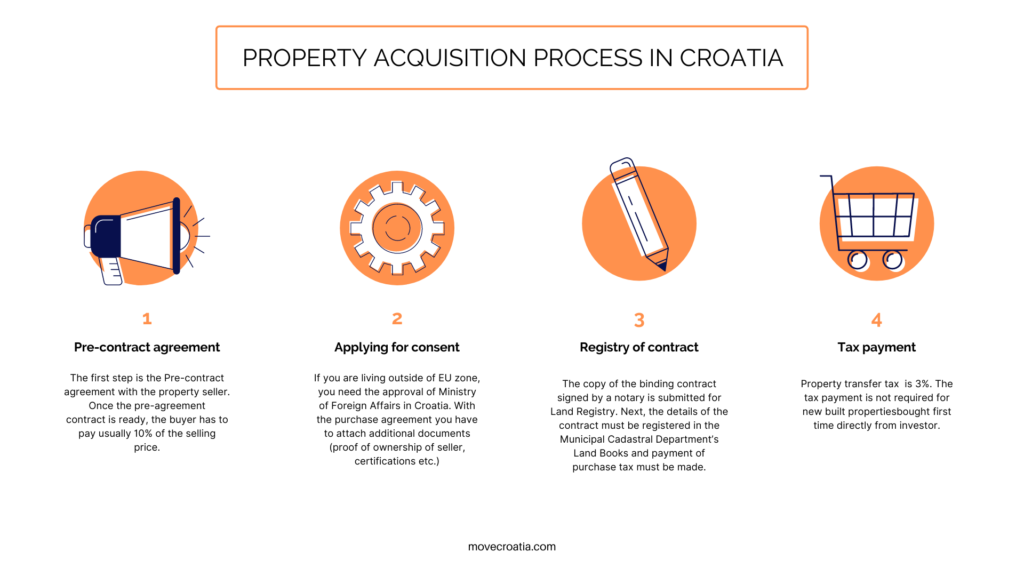

The difference regarding property purchase if you come from the EU country is that you will need consent from the Ministry of Justice in the Republic of Croatia. Without that permission, you won’t be able to finalize the purchase. The whole process can last a couple of months while the Ministry checks the laws and that reciprocity between countries exists.

An important thing to remember is that only Croatian citizens can buy agricultural land and forests (foreign citizens still can’t purchase agricultural land in Croatia – this rule will last until the year 2023).

Find every document on the official website of the Ministry of Foreign and European Affairs in Croatia.

How Brexit affected property buying regulations in Croatia?

All UK citizens who have been living in Croatia under EU law and have temporary or permanent residence, are entitled to purchase the property under the existing regulations. This means that the rights of UK citizens are still the same as those of EU citizens. The Withdrawal Agreement sets out the terms of the UK’s withdrawal from the EU and provides for a deal on citizens’ rights. It sets out a transition period that lasts until 31 December 2020. During this time you can continue to live, work and study in the EU broadly as you did before 31 January 2020.

Are there exceptions for citizens outside of the EU?

If you are not keen on waiting for concentrates from the Ministry of Justice of Croatia there is another option. You can establish a company and buy the property as the company ownership. Croatian companies have equal rights as Croatian legal entities no matter the citizenship of the founder and owner. The company in Croatia can be founded by citizens from all around the world.

Documents you need to attach when asking for consent:

- The basis for property purchase (Purchase agreement, Gift agreement, etc.).

- Proof of ownership (land registry, certificate – not older than 6 months).

- The certificate (not older than 6 months) from the county office of the place where the property is located

- A proof of citizenship for foreign buyers (a copy of passport) and proof of legal entity status.

- The power of attorney, if it is such.

- Proof of payment of tax of 35 HRK (Croatian Kunas) for applying request and 70 HRK for a decision on the acquisition of real estate. For each request update, there are an additional 20 HRK fees.

The address where you should send the request with additional files is Ulica grada Vukovara 49, 10000 Zagreb, Ministry of Justice of the Republic of Croatia

Always pay in Croatian currency

You can see the price of real estate set in Euros as the main currency on many websites or ads. Croatia is still not part of the Euro payment zone. The main currency is the Croatian Kuna. All payments must be made in that currency according to law. This applies whether you are a private individual or you are buying through your company. The only way to purchase the real estate in foreign currency is if you and the seller come from different countries and the transaction takes place outside Croatia. It is expected that Croatia will replace Kuna with Euro by the end of 2021. Until then it would be best to make a transaction in Croatian Kunas.

Can foreign citizens get a mortgage in Croatia?

You should know right away that getting a mortgage or a loan for buying a house or land in Croatia if you are a foreign citizen is not easy. Before approving a mortgage, Croatian banks want assurance that you will pay them back. If you have temporary residency, it is highly unlikely that you will be approved for a mortgage. If you are approved, it will be for a fraction of the purchase price. Most likely, you’ll be flat out refused, since you have not yet proven your long-term connection to the country and they see you as a risk.

The exception would be for the EU citizens, who are technically supposed to be treated like Croatian citizens across the board. The best way to find out if you are eligible for the mortgage in Croatia is to contact directly banks in Croatia. Here is the list of some of the major banks in Croatia:

What is new?

The Ministry of Justice has completed a web service project to connect the land registry information systems ZIS OSS (Regulated Countries) and eNotar, in cooperation with the Croatian Chamber of Notaries. This novelty will now allow citizens and legal entities to complete the land registrations in one step.

Until recently, registration in the land register was a kind of “adventure” that citizens went through by visiting several institutions in order to achieve the desired registration. Now it is possible to perform all actions by going to a notary public once instead of the current practice of going to a notary public, to the Tax Administration, and to the land registry department of the Municipal Court, the Croatian Notary Chamber (HJK) reported.

With the aim of simplifying and shortening the land registry procedure, the Ministry of Justice and the Croatian Notary Chamber have successfully connected the web service (computer application via the Internet) with the land registry information system (for which the abbreviation ZIS-OSS is used) and the central information system of notaries – eNotar.

More tips you can find useful for buying real estate in Croatia

What is OIB?

OIB (Osobni identifikacijski broj | pronounced oh-eeb) is a personal identification number. Croatian citizens and foreigners who have any financial dealings in Croatia must have that number. If you have a bank account, you pay taxes and utility bills, you need OIB. It is necessary to have OIB if you want to buy the property in Croatia. Once you submit the application for identification number you can get it within minutes, depending on how busy the office where you apply is busy. Having an OIB is important if you plan to sign a contract in Croatia (OIB is a required element of every contract in Croatia).

How to open a bank account in Croatia?

You will need your passport or ID card and your OIB. In Croatia, you have to open a bank account in person. Most banks don’t send passwords and PIN codes outside of Croatia. Also, you would probably have to sign some things regarding your privacy and GDPR consent. If you are buying a property it would be better for you to open the account in kuna and other currency of your choice.

How to pay for real estate tax in Croatia?

The real estate transfer tax must be paid within 15 days of receiving the real estate transfer tax certificate. The new practice that eased the process is that now, the public notary has to register the purchase agreements at the Tax authority. Before this new practice, the buyer’s lawyer was the person responsible for this assignment.

Note: If you read somewhere a sentence saying: “After concluding the purchase and sale agreement at the notary public, you have 30 days to register all purchase and sale agreement documents at the Tax authority. The buyer’s attorney usually handles this process.” – you should know that this practice has become outdated and the source where you read this hasn’t updated the information.

After the document submission, the buyer or his representative will receive the demand for tax payment, which you must pay within 15 days from the delivery date. If you don’t pay within the given period, interest will be charged at a rate of 17.5% for every additional day until the payment is made.

Disclaimer: The purpose of this article is to help you understand the process of buying a property in Croatia and to introduce you to the authorities that can help you. Some of the written information may change over time due to the implementation of new laws and regulations. That is why you can contact us at any time. If you have any questions regarding buying real estate, but you are not sure whether the information is correct or some regulations are still in motion, we will be glad to do a research for you.